validator.com

Earn staking rewards with your feet up.

A brand that ...

rewards you while keeping Solana Strong

Established in

2022

Current Staked SOL

510,181

Annual Percentage Yield

8.2% APY

The Team

Here to educate and help the ecosystem.

HFP

Founder

A 17-year branding leader, HFP identified Bitcoin's potential early and, by 2021, recognized Solana's capacity to deliver real-world decentralization. His strategic direction established validator.com's brand and continues to guide its long-term positioning.

Sebastian Montgomery

General Manager

Sebastian started the validator in mid-2022 and leads its growth, operations, and content strategy. A prominent voice in the Solana ecosystem, he has produced more than 1,000 educational videos and continues to drive the vision for the next 1,000 — advancing global understanding of decentralized infrastructure and validator.com

Dan Phillips

Business Developer

Dan is a seasoned professional dedicated to building at the intersection of traditional business and Web3. He holds a Bachelor's degree in Economics and has a strong background in consulting and sales, having worked as an alumnus of industry-leading firms including KPMG, Oracle, and HubSpot.

The Intern

The intern keeps validator.com plugged into Solana's culture and Crypto Twitter. Mixing research, creativity, and humor, into content you want to keep up to date with.

Pedro

Lead Editor & Artist

Pedro leads the creative production at validator.com, crafting visually engaging content that informs, inspires, and connects with audiences. His work focuses on expanding the reach of validator.com and driving broader awareness and adoption of the Solana ecosystem through high-impact storytelling and design.

Chris

Lead Researcher

Steers our content research, breaking Solana updates into plain, useful takeaways.

Link Hub

Find what you want faster.

Security

Enterprise-grade security measures

Follow us for latest updates

Tutorials

How to stake?

Discord

Chat with our community

The Team

People who make things work.

Support

Read our documentation to know more.

Vault

Secure storage for your assets

YouTube

Watch tutorials and updates

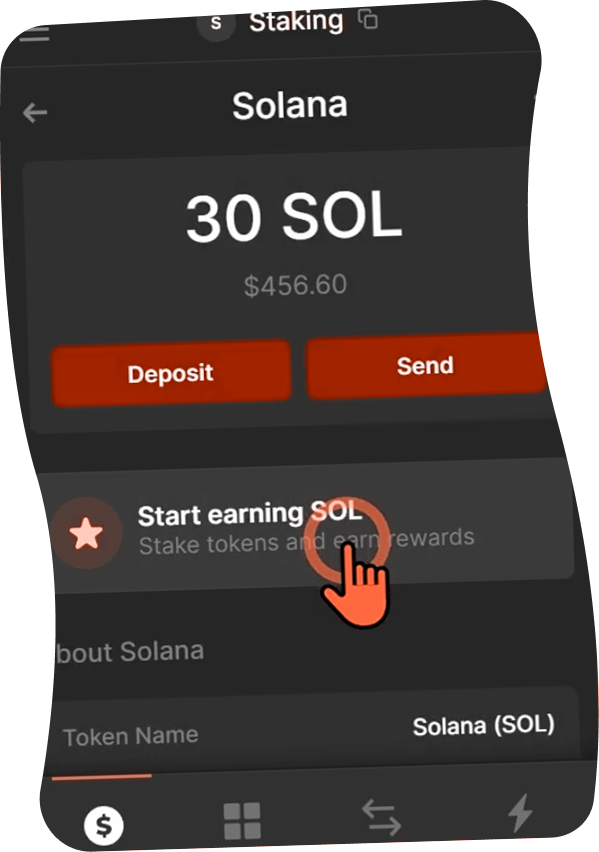

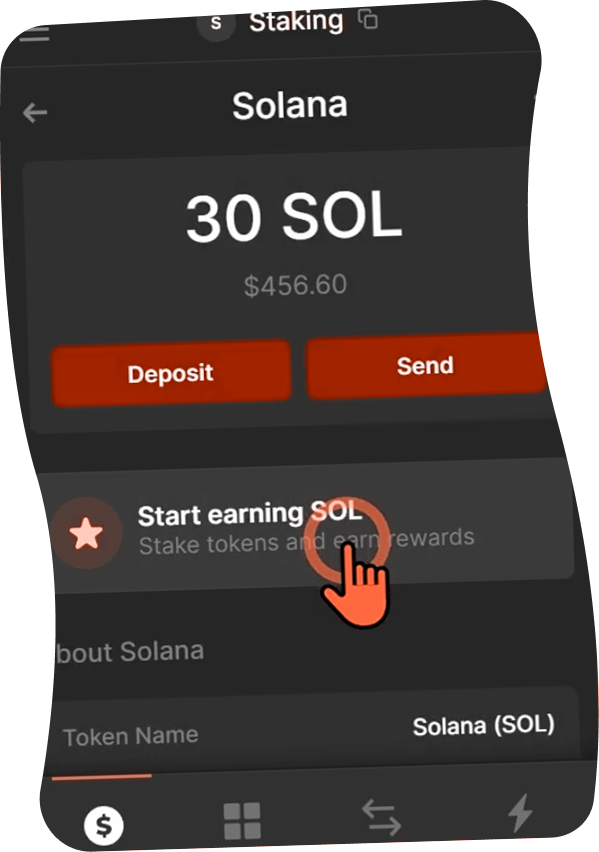

Stake in 30 SECONDS

Your coins. Your custody. Your rewards.

Stake in 30 SECONDS

Your coins. Your custody. Your rewards.

Calculate Staking Rewards

This calculation is based on the current ~ 8.2% APY.

Your

SOL

the current

8.2% APY

8.20 SOL

yearly rewards

*5% on staking rewards, 8% on JITO MEV earnings.